Medicare tax formula

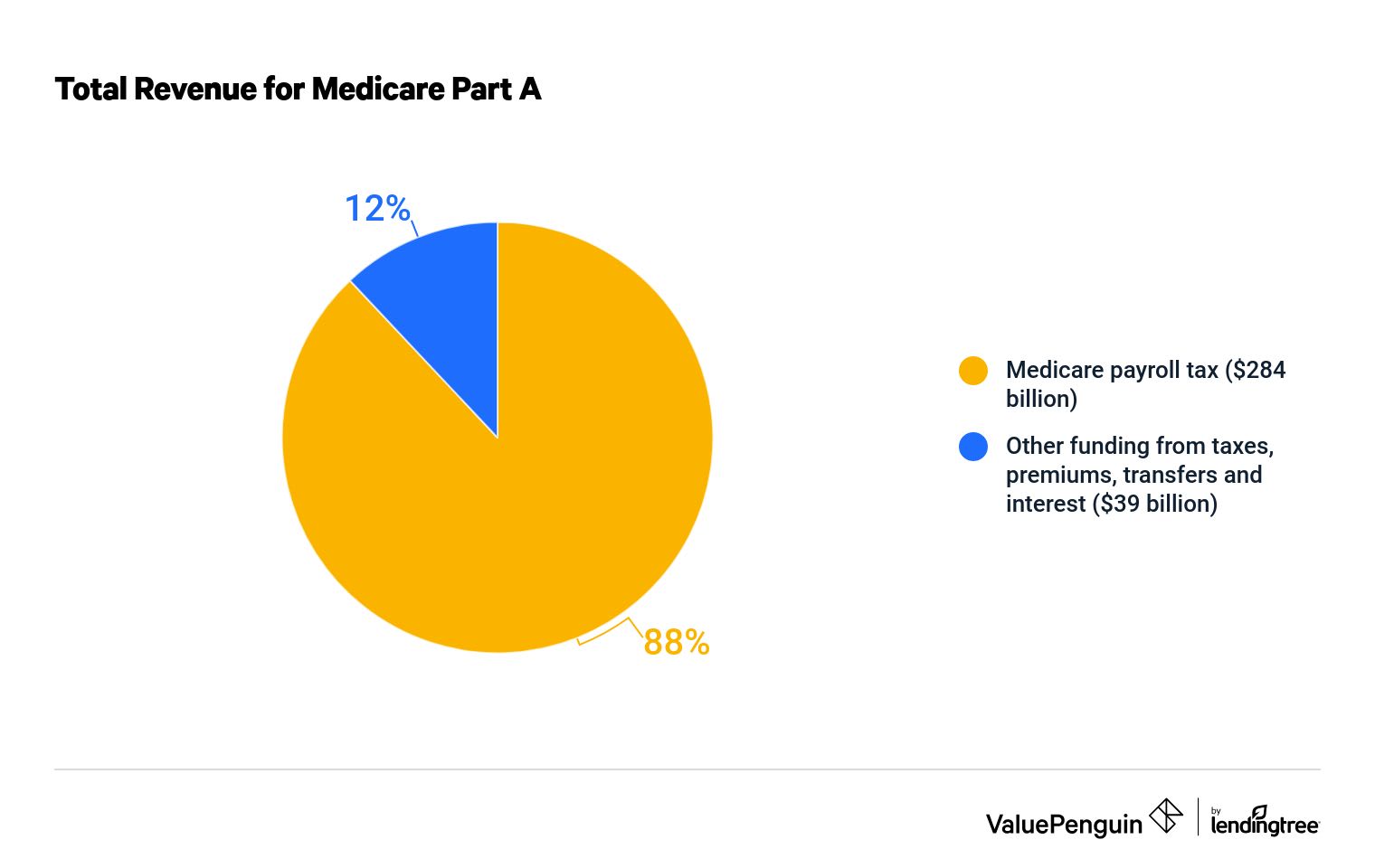

Multiply the Medicare tax rate by the gross. If you paid Medicare taxes for fewer than 40 quarters your 2022 Medicare Part A premium is calculated as follows.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

If you paid Medicare taxes for between 30 and 39 quarters.

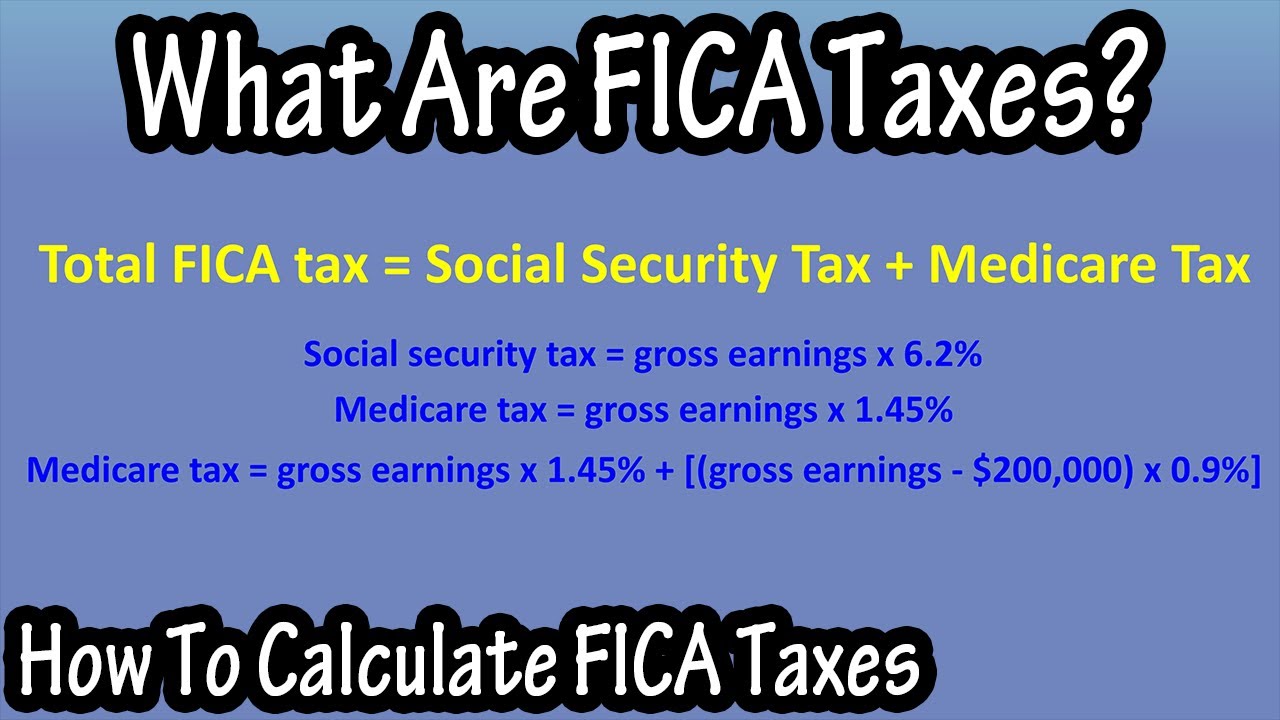

. The Medicare tax rate is 29 of your income. So total FICA tax social security and Medicare tax a personemployer and. If we determine youre a higher-income beneficiary youll pay a larger percentage of the total cost of Part B based on the income you normally report to the Internal Revenue Service IRS.

Before calculating the Additional Medicare Tax on self-employment income the 200000 threshold for head of household filers is reduced by Gs 225000 in wages to 0 reduced but. The Medicare tax rate is 145. The rate is currently 145 of gross wages.

Medicare Levy IFSB228501B2002 ANDB222801 B2-22801 01B2. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively. Beneficiaries who file individual tax returns with modified adjusted gross income.

Beneficiaries who file joint tax returns with modified adjusted gross income. According to the IRS employees and the self-employed pay this tax rate. If B6 is less than or equal to 200000 then B6 145 AND If B6 is greater than 200000 then 200000145 every dollar above 200000 235 For example if.

While zero-premium liability is typical for Part A the standard for Medicare Part B is a premium. What Is The Medicare Tax Rate For 2021. Employees and employers split the 29 tax rate so each pays 145.

Unlike social security Medicare does not have an upper cap where taxes stop being calculated on wages. This formula includes the phase in limits for a. The current rate for Medicare is 145 for the employer and 145.

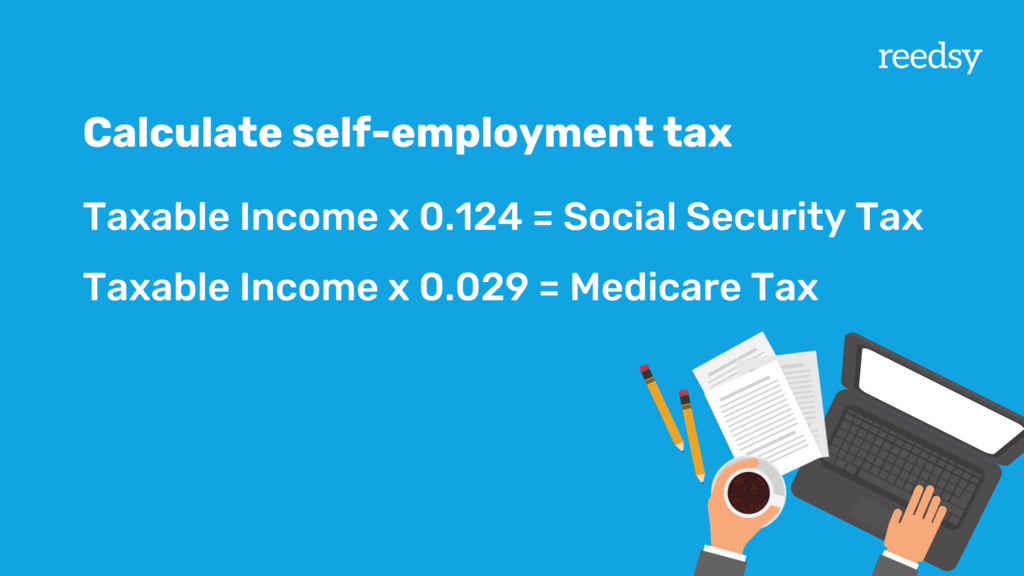

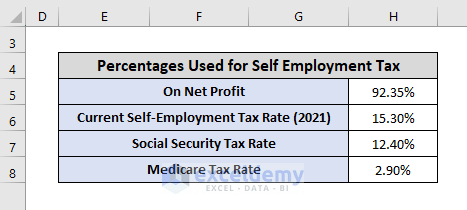

Typically people who are self-employed pay a self-employment tax of. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Medicare taxes for the self-employed Even if you are self-employed the 29 Medicare tax applies.

The employer will also have to pay. Beneficiaries who file individual tax returns with modified adjusted gross income. 252 per month for those who paid Medicare taxes for 30-39 quarters.

When you are self-employed then. The Medicare tax rate is 29 of your income. Medicare tax Gross income 145 or 29.

If you are self-employed you. As such 2000 multiplied by. In Tax Clarity for a married couple filing jointly MFJ with earned income of 252000 the Medicare surtax would be based on the 250000 threshold.

Medicare Part B premium. FICA taxes include both the. If you work for an employer you pay half of it and your employer pays the other half 145 of your wages each.

So each party employee and employer pays 765 of their income for. But the Federal Insurance Contributions Act tax combines two rates. This page provides important information on prescription drug coverage policies under Medicare the framework for CMS review of Medicare.

The IRS considers self-employed people.

How To Do Taxes As A Freelancer In 5 Essential Steps

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Calculation Of Federal Employment Taxes Payroll Services

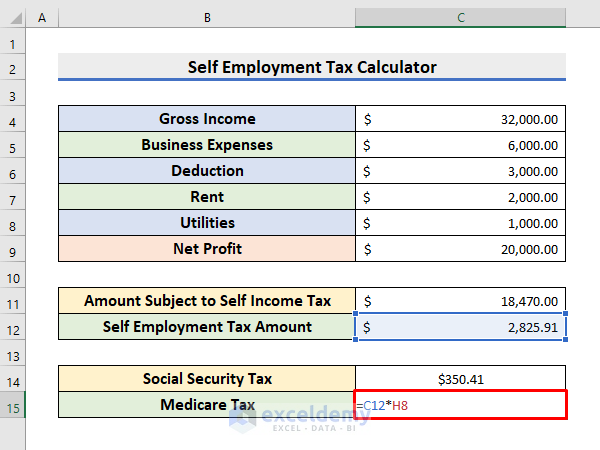

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

What Is Medicare Tax Definitions Rates And Calculations Valuepenguin

How To Calculate Additional Medicare Tax Properly

Self Employed Tax Calculator Business Tax Self Employment Self

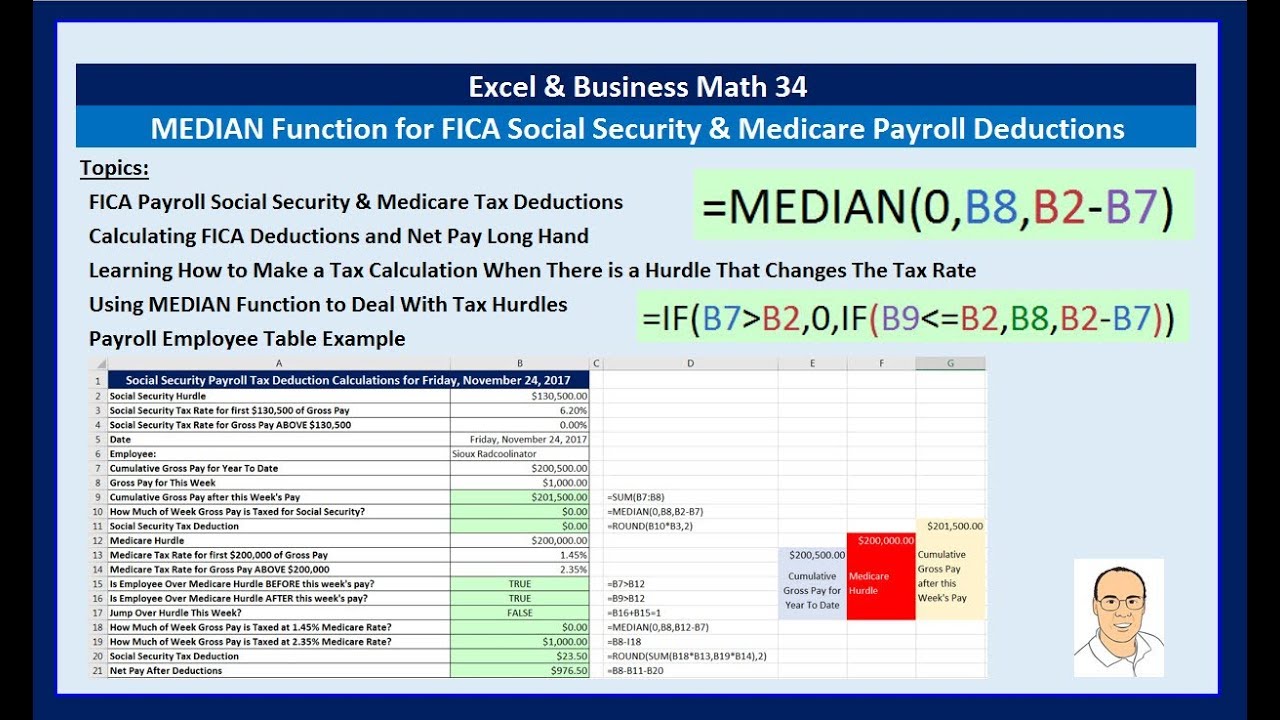

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Solved For Each Of The Following Individuals Calculate The Applicable Course Hero

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Additional Medicare Tax Properly

How To Calculate Payroll Taxes Methods Examples More